Five Ways to buy a $5M home on a Senior Salary

Building big wealth takes a lot more than just putting money in your 401(k).

A friend of mine who works as a Sr. IT leader asked me for ideas on how to achieve his dream of buying a home in Medina, WA. That’s where Bill Gates has his 60,000 square foot mansion.

I started doing some math on what I figured the cheapest home in the area would be, but that’s not what he’s shooting for. We’re talking on-the-water, at least $5M starters.

So, how does one get there in five or even 10 years.

Even with a multiple 6-figure salary, it’s going to take stepping outside of the box. After taxes and living costs in the Seattle area, it would be a feat to set aside $100k annually to save up.

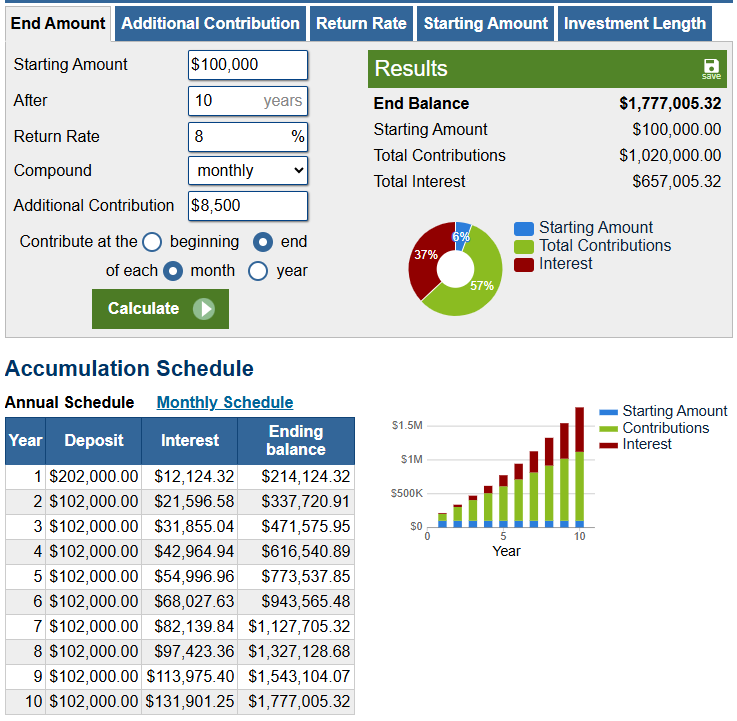

Investing in the stock market, assuming an 8% return, would not even get you half way there in 10 years. Even aggressive assumptions about returns, in something like Real Estate investing, which might hit 12% or more wouldn’t come close in 10 years.

In order to surpass $5 million in 10 years, at $100,000 per year invested, the return rate would need to be close to 25%. Seriously.

Making a cool $5 million in 5-years won’t come easy.

So, how’s he going to make the dream happen? Here are 5 possibilities.

Massively Increase Your Salary

The jump up from a Senior Level role into the C-Level takes time and luck. The bar to climb higher up the corporate ladder gets more and more challenging, takes more time and is simply not going to happen for most people. For every C-Level position there are about 10 people below. So unless you’re on the fast track to CEO it’s time to consider your options.

Often the best way to move up is to move out and into a new company with a higher grade position.

To hit the $5 million nugget, you probably need to be shooting for 7-figure earnings, and that likely means taking a job with a huge performance bonus and a lot of risk, unless you can get hired as a hedge Fund Manager.

Only about 0.1% of Americans have 7-figure earnings, so if you plan to go this route, you’ve need tremendous skill in a super valuable area or tons of luck.

Get Startup Equity

Investing in Startups as an Angel, can be done as side gig can generate big returns, in the range of 27%, which, of done successfully could turn $100k annual contributions into $5M.

It’s also risky and ties up your cash for extended periods, usually at least 5-7 years. Successful Angel Investors place a lot of diverse bets and often invest in groups to get a kind of portfolio effect. The name of the game is to expect one big winner to cover the losses of nine failures.

On the upside, you might also be able to use your knowledge, skills and networks to earn Equity as an advisor and help contribute to the success of the Startups you invest in. You also don’t need to leave your day job, and could join a Startup at a high level if things went well.

Leveraged Investing

This is mostly done with Real Estate, though other approaches exist.

The basic idea is that if you can use your $100k to borrow another $400k to invest in properties generate enough cash flow to cover operating costs and interest through rents, and Real Estate prices are going up then you effectively earn a return on $500k instead of just $100k.

Home values double on average every 10 years, so if you bought and cash flowed a new house every year for 10 years, you’d probably be in the ballpark of $5M, at least in asset values. Also, as rent prices increase and you’ll generate free cash flows.

Build a Successful Side Hustle

It’s hard to give up a hefty salary and start a business, which is our final option. So, why not take your time and slowly build up a lucrative side hustle. Publishing on Substack is a great example of this. Top writers here make seven-figures.

Building a profitable side hustle takes time, a clear strategy and consistency. However, once these kinds of engines build up momentum (i.e. large engaged audiences) they can produce five or even six figure monthly income that’s just icing on the cake.

Considering that the mortgage on a $5M home would be in the $30k monthly range, it’s conceivable that a successful micro-SaaS, Substack, TikTok channel or something along those lines could give you the cash flow needed within 5 years, especially if you are creating a lot of value for your audience.

Become and Entrepreneur

Building a successful business is how most people who generate $5M in wealth quickly get there. It took me about 5 years in my 30’s to start and grow a Software Services business from $0 to $4M and then I sold it for low single digit $ millions.

It’s hard work, risky, sucks the life out of you and can be the most rewarding thing you’ll do in your life. Just don’t let you ex-wife spend all the money like I did, and have to start all over again.

If I could offer a piece of advice about this approach, it’s to plan and prepare well in advance. You need a runway of at least 1-2 years of survival cash, in case you make nothing at the start, and a clear sense of the value you want to create.

Of course, another good option is to acquire an existing business. This also comes with risks, but you might be able to get the owner to carry a lot of the purchase price and be able to pay yourself decently while you make them whole.

It’s a Wrap

So, ready to chase your dreams, mansion on the lake?

Please, comment and share your ideas or thoughts if any come to mind. Every insight helps!